Content

You can study a little more about the deal on the all of our page faithful for the bonus. While you are trying to find having fun with it give, you can capture your chosen 10 deposit online casino added bonus to your this page.

Content

You can study a little more about the deal on the all of our page faithful for the bonus. While you are trying to find having fun with it give, you can capture your chosen 10 deposit online casino added bonus to your this page.

Blogs

Look over all fine print before you could sign up for an account or allege any local casino incentive. The fresh T&Cs will say to you all you need to learn about playing in the webpages and you will the Top rated analysis security the newest terms and conditions of any website we review in more detail.

Blogs

Should you wish to withdraw your unique deposit matter prior to doing the fresh wagering requirements attached to the strategy, you will forfeit your own extra harmony in addition to one related winnings. From the Gambling enterprise, the minimum wagering of an advantage try 30 moments the benefit number and you can any connected put, unless of course if you don’t manufactured in the brand new Special Bonus T&Cs.

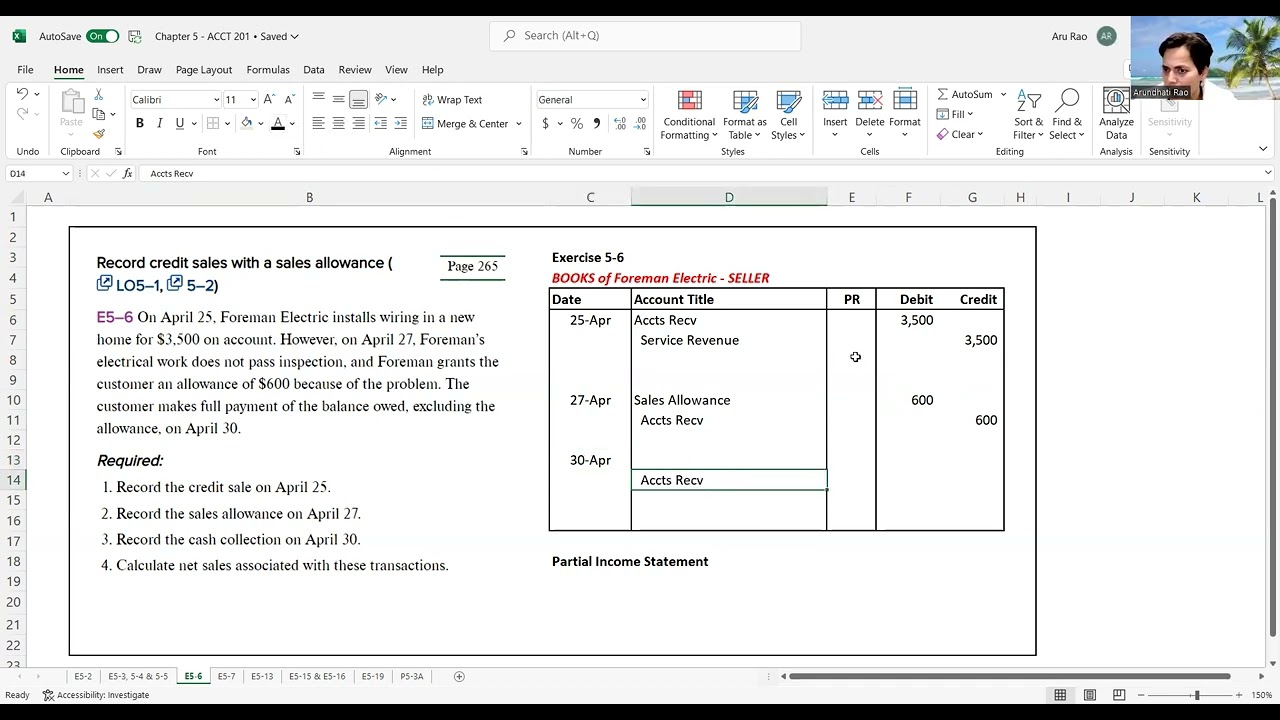

Usually, these companies produce the goods or acquire them from an external source. After production or acquisition, they hold these goods as inventory until customers order them. Once ordered, companies may deliver the goods or request customers to get those goods from a warehouse. It’s critical to understand sales returns and allowances when determining how your business is doing and where it might be going.

Sales Allowances allow retailers like yourself an opportunity to maximize profit margins by selling older or damaged goods and help increase customer satisfaction. Customers appreciate discounts, and it can lead to increased revenue for everyone involved. This example of a sales allowance is used every year by Company XYZ to help get rid of older inventory while also encouraging customers to purchase items still in demand. It’s important to price your products fairly, but it is also important to use a sales allowance to make items more attractive. When you sell an item through your business, there should be some allowance for returns and other contingencies.

In exchange, the company will compensate the customers by repaying them or selling them other products. The company that receives the goods back must return them as sales returns. Companies that sell physical goods may also offer sales returns policies.

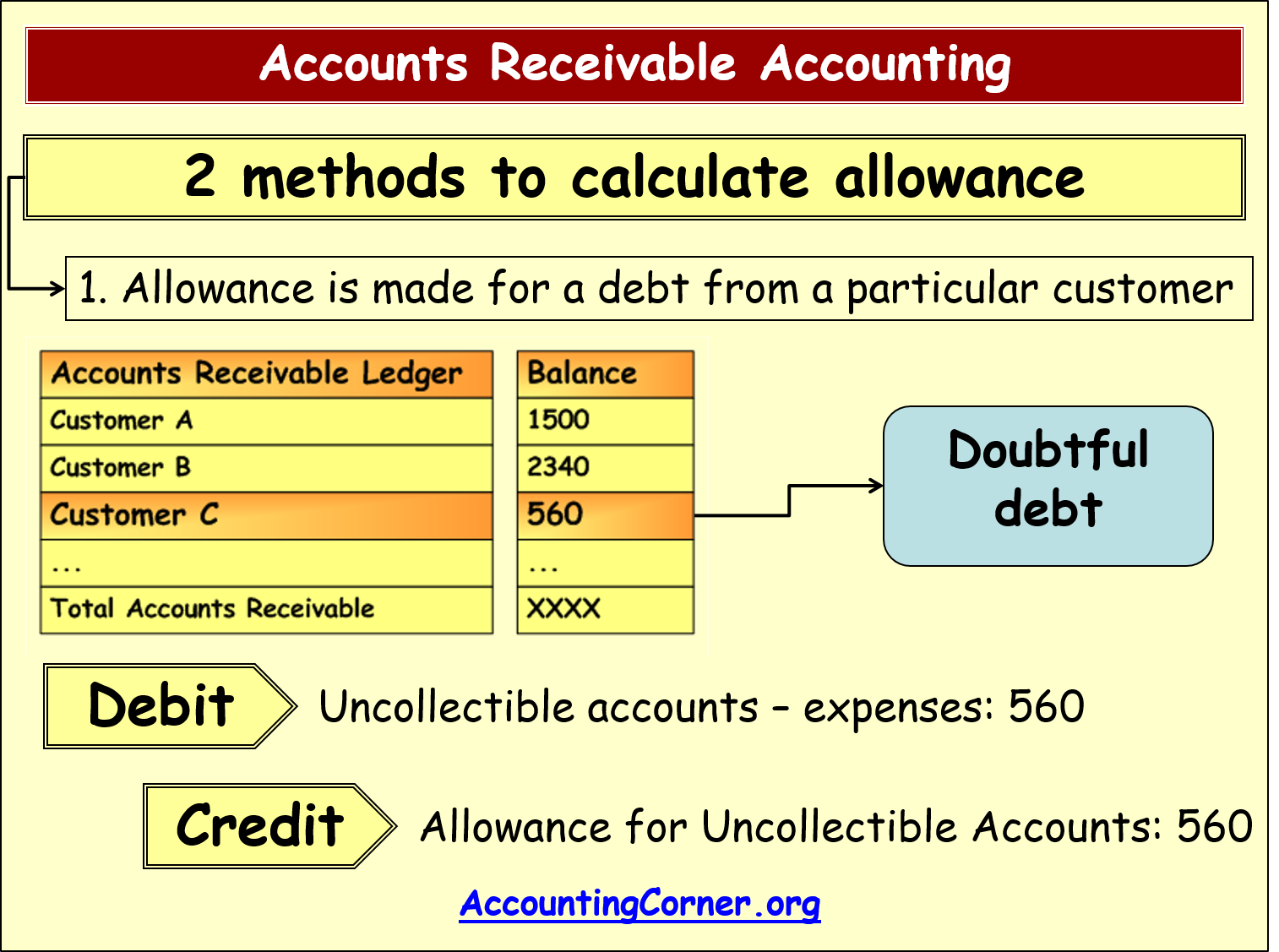

Accurately recording 10 successful cofounders and why their partnerships workeds is a fundamental aspect of maintaining transparent and reliable financial records. The process begins with the issuance of a credit memo, a document that details the allowance granted to the customer. This memo serves as an official record and is essential for both internal tracking and external auditing purposes. It outlines the reason for the allowance, the amount, and the affected invoice, ensuring that all relevant information is captured comprehensively. Sales Discounts is a contra revenue account that records the value of price reductions granted to buyers in order to incentivize early payments. Examples include Net D cash discounts like 2/30 Net 60, where a full invoice payment is due in 60 days but a buyer will receive a 2% discount in case of an early settlement within 30 days.

Sales returns, allowances and discounts are some of the examples of this type of contra account. Some companies may keep these accounts together due to their similar nature. However, others will separate them into two accounts for better presentation and processing.

This was done as part of their annual inventory reduction plan, which occurred from October through December each year. This also allowed individuals who bought items during this time period additional savings over those who purchased these things after 2023 began. A control account allows you to easily follow the balances of related accounts by following the balance of the control account. The accounts that are related to each other (the ones with the same column heading) are said to be controlled by or linked to each other, and they share a common control account. When posting to the accounts receivable controlling account, the account number of accounts receivable (112) was written to the left of the diagonal line.

In this case, the firm decided to provide a $1,000 sales allowance as a discount for the delayed delivery of the software. The Overbook Sales Allowance taskcan be granted to permit sales agents to override the sales allowancelimit and continue with the group block creation. The opposite of the revenue contra accounts Sales Discounts, Returns and Allowances are expense contra accounts Purchase Discounts, Returns and Allowances. Net sales do not account for cost of goods sold, general expenses, and administrative expenses which are analyzed with different effects on income statement margins. When the above entry was posted to the accounts receivable ledger, a small checkmark was made to the right of the diagonal line.

In the context of returns and allowances, it means expanding your returns and allowances account. A sales allowance, unlike sales return, involves no physical return of the product. Instead, the business gives a certain deduction from the original price of the item. If the customer agrees to keep the product, the reduction in the price is recorded as sales allowance. Management usually wants to record sales allowances in a separate account, so that the aggregate amount of allowances given is clearly visible. A large balance in this account is an indicator that a business has considerable problems with its products, or damage to those products while in transit.

Sales allowances aim to strike a balance between meeting customer expectations and maintaining accurate financial records. The new revenue recognition standard, ASC 606, further emphasizes the importance of accurately accounting for sales allowances. Under ASC 606, companies must estimate the amount of variable consideration, including sales allowances, that they expect to provide to customers. This estimate must be updated regularly to reflect any changes in circumstances, ensuring that the financial statements remain accurate and up-to-date.

Planning a marriage https://asianbrides.org/israeli-women/, whether you’re getting married in the us or overseas, takes time and patience in addition to numerous actions. There are numerous tasks and ceremonies that must be finished in order for your weddings to be legally recognized and celebrated, from choosing the ideal location to setting up a registration. We’ve provided an Asian wedding preparing timeline to help you stay on track and walk you through the steps involved in creating your ideal ceremony.

Although applying for a relationship license may be the least loving option on the list, it https://www.dosomething.org/facts/11-facts-about-women-around-world is crucial to find things started well in advance of your major time. Usually, you should finish this step at least six months before your wedding.

Finding a West Eastern bride manager or hiring one is strongly advised due to the extensive character of the elements that go into standard Indian or Chinese weddings. A manager will be able to control the shipping on your behalf and offer advice on how to choose vendors for each occurrence.

Create a budget: Before going too far with arranging, it’s best to create if it will give you the freedom to plan your ideal function without exceeding your resources. This number may be heavily influenced by the size of your ceremony and the number of guests, but it’s also crucial to consider styling preferences and clothing preferences.

Choose whether you’ll have a Mehndi Party, Haldi Ceremony, or Sangeet: It’s best to decide on these facts as soon as possible so that you can submit the date, day, and chef for each function. Additionally, now is the perfect time to choose whether to hire a Dai Kam Jie or Chaperone to marry the bride. Whether it’s a close friend or an acquaintance, this individual does travel with the wife through each festival.

Secure gay black dating may be a great way to find love. with many different dating sites available, you will find somebody who shares your passions and whom you can feel safe around. there are many different forms of secure gay black internet dating sites available, to help you find the right one available. the best secure gay black dating sites consist of blacklove.com, blacksingles.com, and blackcupid.com. these sites are all great choices simply because they have a wide variety of features and choices. you’ll find a secure gay black dating website that is ideal for you. you can also find secure gay black internet dating sites on mobile apps. these apps have actually most of the exact same features while the internet sites, but they are also simple to use on your phone. if you’re finding a secure gay black dating site, you should certainly browse blacklove.com. this site has a fantastic choice of features and options, which is user friendly. there are also plenty of great individuals on this site.

Finding your perfect match can be hard, but with the help of some key keywords, it could be made easier. when searching for anyone to share your life with, it’s important to start thinking about such things as compatibility, interests, and lifestyle. however, about finding somebody who’s also gay, black, and secure, it could be even more complicated. there are a variety of things to consider whenever searching for a secure gay black partner. first of all, it’s important to consider your compatibility. have you been both enthusiastic about equivalent things? do you share exactly the same values? do you have similar love of life? when you have determined your compatibility, it is vital to explore your passions. do you take pleasure in the exact same types of music? are you currently both more comfortable with residing a specific means? are you both more comfortable with spending time alone or with other people? are you currently both more comfortable with staying in a sizable town or a tiny town? when you have determined your security, it is vital to consider your compatibility once again. have you been both compatible with each other?

Secure gay black relationship is a great way to connect with other like-minded individuals and revel in the many advantages that come with it. this kind of dating is especially very theraputic for those who are wanting a serious relationship, as it offers a safe and secure environment in which to meet up brand new people. one of the biggest advantages of secure gay black dating would be the fact that it may be a terrific way to satisfy brand new buddies. unlike traditional dating sites, in which users are typically trying to find an intimate partner, secure gay black dating is perfect for those people who are in search of buddies. the reason being users aren’t limited to messaging only other people, and will also join forums and forums in which they could engage in conversations along with other users. the reason being users can explore their options in order to find somebody who is a good complement them. if you should be finding a safe and secure environment in which to meet up with brand new individuals, then secure gay black dating may be the perfect dating choice for you.

Secure gay black males are those whom share similar values and objectives with you. they are seeking an individual who works and shares the exact same passions. they want an individual who is understanding and supportive. they want somebody who is trustworthy and reliable. they desire somebody who is passionate and committed.

Finding love is hard, however it doesn’t always have to be difficult if you are finding a safe and inviting community. with secure gay black dating, you’ll find someone who shares your interests and who you can trust. when looking for a secure gay black dating website, you should think about these factors:

your website’s protection

one of the more critical indicators to take into account when looking for a secure gay black dating website is the website’s protection. make sure that your website you’re utilizing is safe and it has a good protection policy in position. your website’s features

another important factor to think about when searching for a secure gay black dating website is the website’s features. ensure that your website has features being relevant to your needs, particularly a user program that is easy to use. be sure that the website has various account amounts, in order to find the correct match available. when searching for a secure gay black dating internet site, remember to look at the above facets. in so doing, there is the right website that’ll fit your needs and that provides you with the security and features that you’ll require.

Finding someone to date on secure gay black dating is a daunting task. with so many choices and people to pick from, it could be difficult to get someone who is a great fit for you. below are a few ideas to help you find the perfect match on secure gay black relationship:

1. join a dating site which designed for secure gay black relationship. this will offer you a wider array of options and people to choose from. 2. use the search function on the website to find people that are a good match for you. this may allow you to find individuals who share your interests and values. 3. be open-minded whenever dating on secure gay black dating. which means that you ought not hesitate to use brand new things and satisfy brand new people. 4. it can take time to find the right person. 5. this will help to build a trust relationship along with your prospective dates.

Posts

The advantages of an informed casino deposit incentive offers try aplenty. They are the enthusiast-favorite hobby to the gambling web sites, as there are reasonable for this. Four from four product sales try Acceptance also offers, which is not shocking provided just how common this type of boosters try.

This can be a limit about how much you can win away from their harbors added bonus.

Blogs

Gaming now offers each other require you to deposit some funds to help you lead to the main benefit. Yet not, the brand new deposit fits introduction promotions are arranged to own very first-time depositors, if you are reload bonuses are around for all the existing pages. Web sites render regular reload bonuses to have established profiles, especially around big getaways. The fresh St.

Content

A premier gambling on line website has put tips in your life and faith. Awesome Ports is a superb on-line casino for both novices and you will educated players. That it dependable gambling establishment only has been around since the 2020, but is section of an elite group away from web sites detailed with Wild Gambling enterprise.

Blogs

Simply clicking Enjoy Now below guarantees an informed bargain – that has dos,500 within the Prize points after you bet $twenty five at the internet casino. Because of zero-deposit offers, Canadians can be are their hand from the various other gaming titles. Nonetheless it’s worth mentioning the point that such also offers are quite unusual. Thus, you should examine this type of positives and negatives and decide for oneself perhaps the give may be worth your time.